Holistic project and change management

A few weeks ago, I had a most refreshing conversation with a global Portfolio Director working for a division with about 40 factories spread over 15 countries. She mentioned they don’t use or have a need for change managers (CM). As Portfolio Director she manages the main stakeholders and during the projects, their Program and Project Managers (PM) focus on stakeholders management and on the people side of a change.

She explained. Their change & implementation list is long. As Portfolio Director she ensures the senior and the main stakeholders are fully committed to the change/project upfront, otherwise the project will not start, not even make it to the plan. If she, and for instance country managers, cannot bring the added value or necessity of a change across to one of their peers, a PM certainly will not be able to. “If the main stakeholders are not accepting and driving the change, don’t waste the team’s effort, and avoid frustrations. But if the main stakeholders are on board, the project gets on the plan, and the plan is approved: the project will be executed.”

Once upon a time, managing stakeholders and the people side of a change were important tasks of a PM. To limit derailing projects, standard project methodologies were introduced. Followed by a time of enforcing the standard processes, templates, stage-gates, formal updates, etcetera. The direct measurable side of project management was elevated, leaving stakeholder management and managing the people side of a change with too little care and attention. The next frequent reason why changes were not successful occurred.

And see; the CM role/function was born. By now we are used to split jobs/tasks into different roles, and for larger changes, to consider change management a separate expertise and function. A role and function which is maturing and professionalizing over time.

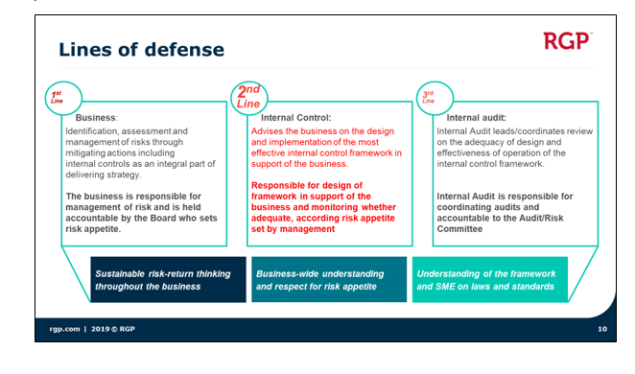

Let’s make a comparison to risk management. A sales department, where performance is measured by sales volumes KPI’s, will lose to feel the risk of not being paid. Over time, the department’s culture evolves and the clients’ solvency is no longer considered when deals are closed. Organizations faced the financial consequences, and a separate risk management function (the so called 2nd line of defense) was introduced to fix the gap. They support and guide the business (the 1st line of defense) how to identify and manage risks, and they re-build a risk aware culture. As a result, risk management is becoming again the responsibility of the business (the 1st line of defense) and in a number of companies, the 2nd line of defense, the separated risk management function no longer exists. What about the change management role/function? Will it be an expertise which further matures and is here to stay? Or has change management similarities to risk management, and will their tasks, focus and capabilities over time be re-absorbed by the PMs and will specialist roles like communications and training remain?

Regardless the future developments of the change management role/function, for most projects a strong focus on the people side of change is a pre-condition to reach the end goal, to make the change sustainable, and to reach the intended business benefits. When change management is not fully integrated in the veins of PMs, the projects will benefit from, or will only be successful when, the people side of change is being taken care of by a change specialist, by a CM.

So, why was the conversation with the Portfolio Director so refreshing? Because i) the early and top-down stakeholder management is embedded in the organization, ii) only committed and executable projects are started and iii) people side of change is a fully integrated part of managing a change or project. Management support, resources availability, creating focus/drive of all involved, creating awareness/understanding/the right capability, are all natural components of approaching changes and projects holistically. Not in words like this blog, but because the Portfolio Director was living it as example.

Purpose of this governance model is not minimizing risk which would hinder business activities but an optimized risk/return.

Purpose of this governance model is not minimizing risk which would hinder business activities but an optimized risk/return.